Demand drivers

The demand for Konecranes’ products and services are driven by market conditions in the manufacturing industry, including the general manufacturing, metal production, power generation, automotive, pulp and paper, raw materials, and chemical industries, and container transportation industry.

Customers generally invest in new equipment either to expand capacity or replace old equipment. Investment in new lifting equipment is cyclical and varies across different industries depending on the economic environment for that industry. Nevertheless, Konecranes believes increasing demand for higher productivity, safety and ecological-efficiency presents growth opportunities for new lifting equipment sales.

Customer segments

Container handling Shipyards Waste-to-energy Pulp and paper Automotive

![]()

![]()

![]()

![]()

![]()

Power Steel Manufacturing Mining Petrochemical

Customers

Historically, Konecranes’ largest customer has accounted for less than 2% of its net sales and Konecranes’ top ten customers have in the aggregate accounted for less than 10% of its net sales.

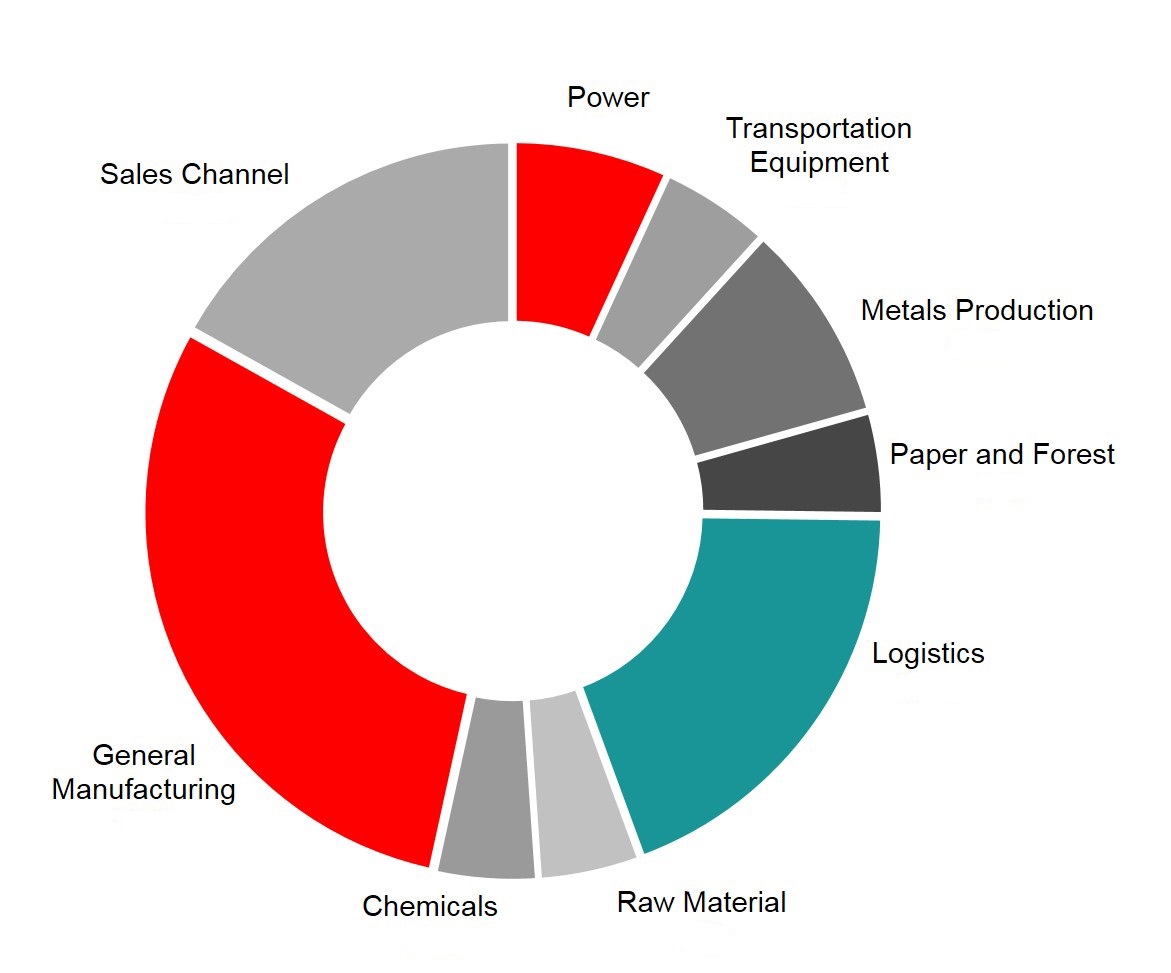

Approximately 80 percent of Konecranes’ customers are in the industrial production sector, including general manufacturing, metals, power generation, petrochemicals and pulp and paper. In general, Konecranes’ customers’ need for services and new equipment is linked to industrial production volume and capacity utilization.

The remaining approximately 20 percent of Konecranes’ customers are container ports and terminals. Their propensity to buy services and new equipment is generally related to world trade and container volumes.

Konecranes sales by customer segment

Distribution

Business Area Service

Konecranes delivers on-site maintenance services to its customers through its extensive network of inspectors, technicians and technical specialists. Service branches provide a local presence in most industrial markets supported by regional and global distribution centers, training centers and technical support centers. Konecranes is rolling out globally an advanced information technology system, which systematically stores the service history for each maintained lifting device, provides its customers with maintenance and usage information, enabling a consultative approach to maintenance, brings global service processes to local use, and makes material management transparent and efficient.

Business Area Equipment

Konecranes employs its own sales teams, focusing on true sales excellence by way of strong sales management and leveraging the benefits of its wide product offering to meet the varied needs of its vast customer base, as complemented by the comprehensive service offering described above.

Konecranes has direct sales to customers in its industrial cranes and heavy port equipment businesses as well as lift trucks in certain countries. In most of the countries in which Konecranes operates, lift trucks are distributed through dealers. Konecranes’ power brands distribute crane components through OEM crane builders and dealers. Konecranes believes that its diversified distribution network ensures a wide market and geographic coverage, which extends to over 100 countries.

Competition

The following table shows certain primary competitors for Konecranes’ products in the following categories:

Industrial cranes and components | Port cranes | Heavy duty lift trucks | Service | |

|---|---|---|---|---|

Columbus McKinnon, USA | X | X | ||

Kito, Japan | X | |||

Abus Kransysteme, Germany | X | |||

GH, Spain | X | X | ||

OMIS, Italy | X | X | ||

Weihua, China | X | |||

Shanghai Zhenhua Port Machinery (ZPMC), China | X | X | ||

Kalmar (part of Cargotec), Finland | X | X | X | |

Liebherr, Germany | X | X | X | |

Taylor, USA | X | |||

CVS Ferrari, Italy | X | |||

Mitsui Engineering&Shipbuilding, Japan | X | |||

Kunz, Austria | X | |||

Hyster, USA | X | |||

Sany, China | X | X | ||

Dealers, full service providers, installation companies, in-house | X |